NVRA Market Reports are sponsored by the North Country Federal Credit Union

The 2022 real estate market begins where 2021 left off, in which existing home

sales reached their highest level since 2006, with the National Association of

REALTORS® reporting sales were up 8.5% compared to the previous year as

homebuyers rushed to take advantage of historically low mortgage rates. Home

sales would’ve been even greater were it not for soaring sales prices and a

shortage of homes for sale in many markets, forcing a multitude of buyers to

temporarily put their home purchase plans on hold.

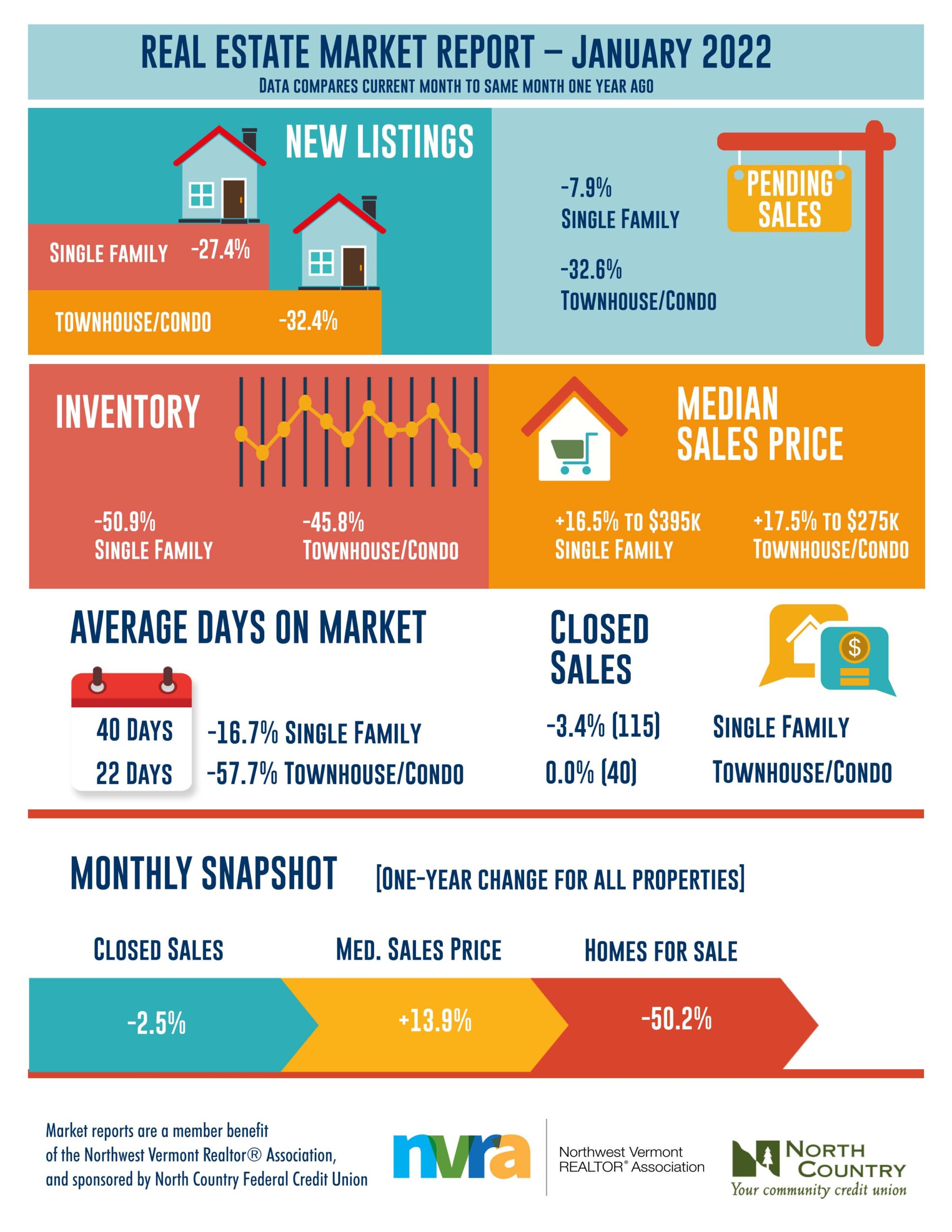

New Listings decreased 27.4 percent for single-family homes and 32.4 percent

for townhouse-condo properties. Pending Sales decreased 7.9 percent for

single-family homes and 32.6 percent for townhouse-condo properties.

Inventory decreased 50.9 percent for single-family homes and 45.8 percent for

townhouse-condo properties.

The Median Sales Price was up 16.5 percent to $395,000 for single-family

homes and 17.5 percent to $275,750 for townhouse-condo properties. Days on

Market decreased 16.7 percent for single-family homes and 57.7 percent for

townhouse-condo properties. Months Supply of Inventory decreased 50.0

percent for single-family homes and 42.9 percent for townhouse-condo

properties.

For many buyers, 2022 marks a new opportunity to make their home purchase

dreams a reality. But it won’t be without its challenges. Inventory of existing

homes was at 910,000 at the start of the new year, the lowest level recorded

since 1999, according to the National Association of REALTORS®, and

competition remains fierce. Affordability continues to decline, as inflation,

soaring sales prices, and surging mortgage interest rates reduce purchasing

power. The sudden increase in rates and home prices means buyers are

paying significantly more per month compared to this time last year, which

may cause sales to slow as more buyers become priced out of the market.