NVRA Market Reports are sponsored by the North Country Federal Credit Union

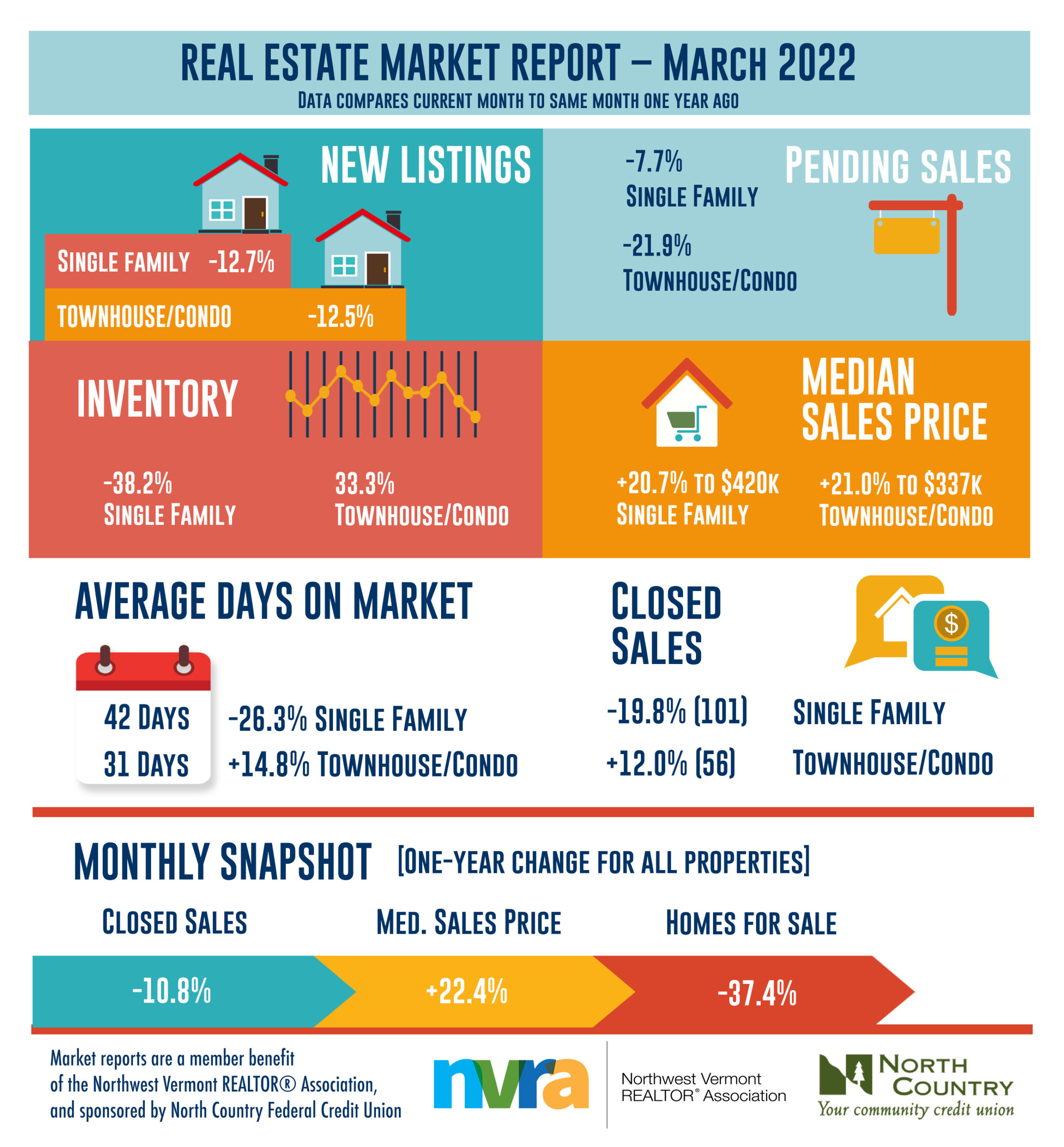

Nationally, existing home sales recently dropped to a 6-month low, falling 7.2% as buyers struggled to find a home amid rising prices and historic low inventory. Pending sales are also down, declining 4.1% as of last measure, according to the National Association of REALTORS®. Builders are working hard to ramp up production—the U.S. Census Bureau reports housing starts are up 22.3% compared to a year ago—but higher construction costs and increasing sales prices continue to hamper new home sales, despite high demand for additional supply. New Listings decreased 12.7 percent for single-family homes and 12.5 percent for townhouse-condo properties. Pending Sales decreased 7.7 percent for single-family homes and 21.9 percent for townhouse-condo properties. Inventory decreased 38.2 percent for single-family homes and 33.3 percent for townhouse-condo properties. The Median Sales Price was up 20.7 percent to $420,000 for single-family homes and 21.0 percent to $337,500 for townhouse-condo properties. Days on Market decreased 26.3 percent for single-family homes but increased 14.8 percent for townhouse-condo properties. Months Supply of Inventory decreased 38.5 percent for single-family homes and 25.0 percent for townhouse-condo properties. Across the country, consumers are feeling the bite of inflation and surging mortgage interest rates, which recently hit 4.6% in March, according to Freddie Mac, rising 1.4 percent since January and the highest rate in more than 3 years. Monthly payments have increased significantly compared to this time last year, and as housing affordability declines, an increasing number of would-be homebuyers are turning to the rental market, only to face similar challenges as rental prices skyrocket and vacancy rates remain at near-record low.